The smart Trick of Financial Advisor Fees That Nobody is Discussing

Wiki Article

The Greatest Guide To Financial Advisor Ratings

Table of ContentsFinancial Advisor Jobs - The FactsThe Of Financial Advisor MagazineFinancial Advisor Definition Fundamentals ExplainedWhat Does Financial Advisor Do?

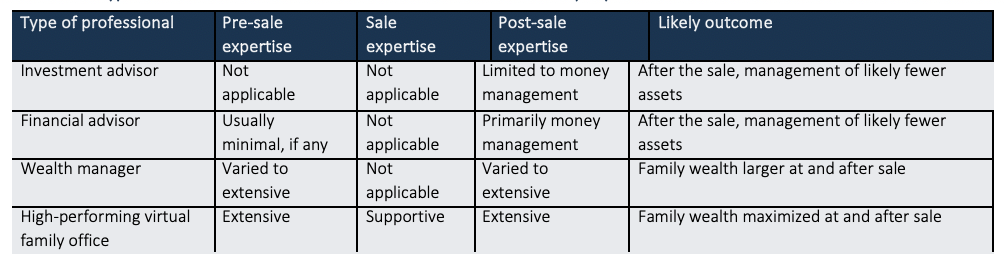

There are a number of kinds of economic advisors out there, each with differing credentials, specializeds, as well as degrees of responsibility. As well as when you're on the search for a specialist fit to your demands, it's not uncommon to ask, "Just how do I understand which monetary consultant is best for me?" The response begins with a truthful accountancy of your needs as well as a little of research study.Types of Financial Advisors to Think About Depending on your financial demands, you might opt for a generalised or specialized economic advisor. As you start to dive into the world of seeking out an economic advisor that fits your needs, you will likely be provided with many titles leaving you questioning if you are speaking to the appropriate individual.

It is essential to note that some financial advisors also have broker licenses (meaning they can offer safety and securities), however they are not only brokers. On the same note, brokers are not all accredited just as and are not financial experts. This is simply among the lots of reasons it is best to begin with a qualified financial planner who can recommend you on your financial investments as well as retired life.

Some Known Facts About Financial Advisor Near Me.

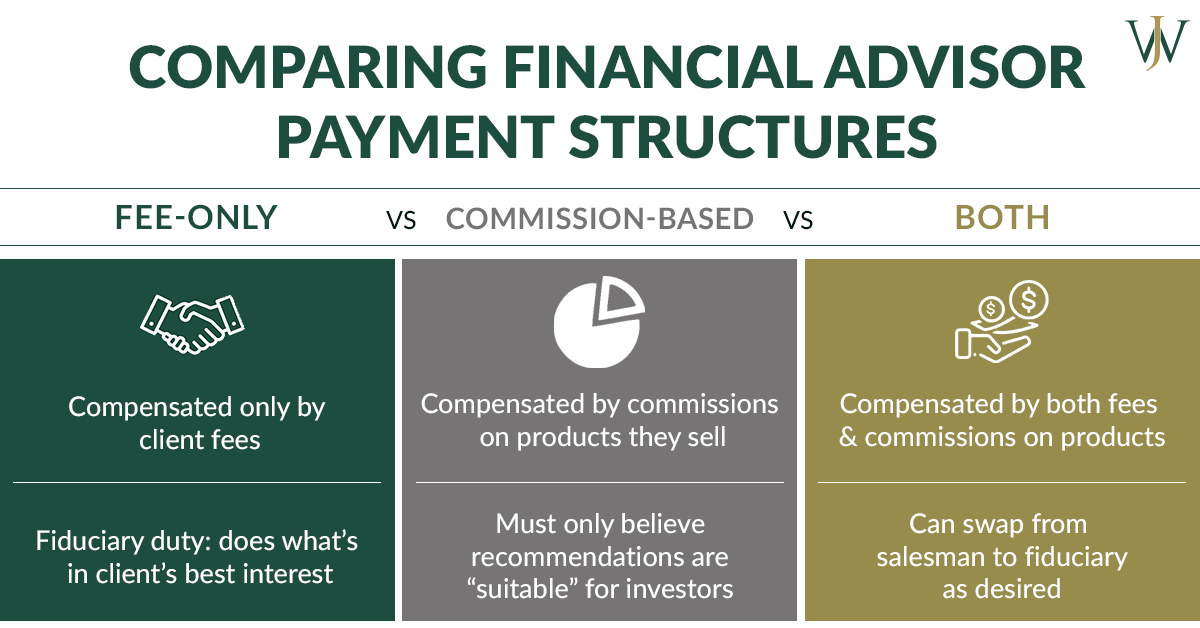

Unlike financial investment advisors, brokers are not paid straight by clients, rather, they earn payments for trading stocks and bonds, as well as for offering mutual funds and other items.

You can normally tell a consultant's specialty from his/her monetary accreditations. For instance, a recognized estate coordinator (AEP) is a consultant who specializes in estate planning. So when you're seeking an economic advisor, it behaves to have a suggestion what you want aid with. It's additionally worth mentioning economic organizers. financial advisor license.

Just like "financial advisor," "monetary organizer" is also a broad term. A person with that said title could also have other qualifications or specialties. No matter your certain demands as well as economic circumstance, one standards you need to strongly consider is whether a potential expert is a fiduciary. It may stun you to learn that not all financial consultants are called for to act in their clients' best rate of interests.

How Advisors Financial Asheboro Nc can Save You Time, Stress, and Money.

To secure on your own from somebody that is simply pop over here attempting to obtain even more money from you, it's a good idea to seek an expert that is signed up click here for more as a fiduciary. A financial consultant who is signed up as a fiduciary is called for, by regulation, to act in the very best rate of interests of a client.Fiduciaries can just recommend you to utilize such items if they assume it's in fact the most effective economic choice for you to do so. The U.S. Securities and Exchange Payment (SEC) manages fiduciaries. Fiduciaries who fail to act in a customer's benefits might be hit with penalties and/or jail time of up to 10 years.

Nevertheless, that isn't due to the fact that anybody can get them. Obtaining either qualification requires a person to experience a selection of classes and examinations, along with making a collection quantity of hands-on experience. The result of the certification process is that CFPs and Ch, FCs are well-versed in subjects across the area of personal financing.

The charge can be 1. Charges normally lower as AUM rises. The choice is a fee-based advisor.

The Definitive Guide for Financial Advisor Magazine

An advisor's management charge might or may not cover the prices associated with trading safeties. Some experts also bill a set cost per purchase.

This is a solution where the advisor will certainly pack all account management prices, including trading fees and also expenditure ratios, right into one detailed fee. Due to the fact that this fee covers extra, it is generally greater than a cost that just includes monitoring and also excludes things like trading prices. Wrap charges are appealing for their simplicity but also aren't worth the expense for every person.

They also charge costs that are well below the expert costs from traditional, human advisors. While a conventional expert generally bills a fee in between 1% and 2% of AUM, the cost for a robo-advisor is normally 0. 5% or much less. The big trade-off with a robo-advisor is that you often do not have the ability to speak with a human consultant.

Report this wiki page